Dear Investor,

KYC compliance is now Mandatory.

This is to update you on the requirements of Prevention of Money Laundering Act, 2002, and the subsequent guidelines issued by the Securities and Exchange Board of India (SEBI) and Association of Mutual Funds in India (AMFI) to ensure compliance with the same. As per the law all mutual Funds are required to verify identity and maintain records of all their investors through the mandated Know Your Customer (KYC) process with effect from February 01, 2008.

Applicability of KYC

Effective February 1, 2008 for any investment in mutual funds (which includes fresh /additional purchases and new SIP registrations) of Rs.50, 000/- or more, KYC must be completed for all unit holders (including NRI's and Person of Indian Origin) / investors in a folio (including guardian where the investor is a minor) irrespective of the mode of holding, and any Power of Attorney holders.

Investments where KYC is not completed will be liable for rejection by the Mutual Fund effective 1st February 2008. As the Anti money laundering laws are mandatory and require urgent action, we request you to comply with the KYC norms in order to continue investing in your mutual fund account with us.

Completing KYC and PAN formalities is simple

All mutual funds have appointed CDSL Ventures Ltd ("CVL") to help investors to complete KYC formalities on their behalf. The investors need to submit their details only once for completion of KYC formalities across all mutual funds.

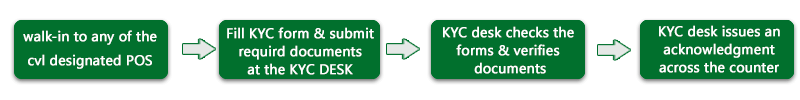

The flow chart given below illustrates the process of completion of KYC:

Documents required to complete KYC:

All you need to do is complete the KYC form and submit along with the following documents at any of the designated 'Point of Service' (POS) of CVL.

1. A recent passport-size photograph

2. Copy of PAN card and

3. Proof of address for Individuals,

4. For Corporate Documents for bodies corporate

Please note that these documents needs to be:

1. submitted in original along with a self-attested copies, where the original will be returned across the counter after verification.

Or

2. duly attested by a manager of a scheduled commercial bank (the designation seal should be affixed), notary public or gazetted officer.

You must remember:

1. On submission of the KYC application form and documents to CVL, you will receive an acknowledgement across the counter, a copy of which must be submitted to us as proof of having completed KYC formalities.

2. If you have already completed KYC formalities through CVL and obtained a KYC acknowledgement, please submit a copy of the same to us along with a list of folio number(s). After due verification, folio(s) will be updated in our records and you can continue to transact with us as before.